Malaysian Bulk Carriers Bhd. is the largest drybulk shipowner in Malaysia engaged in international shipping. It presently owns and operates a fleet of vessels which includes dry bulk carriers and product tankers. Bulk carriers are involved in the transportation of dry cargoes comprising major bulks such as iron ore, coal, grains and minor bulks like sugar, coke, fertilisers. Tankers are engaged primarily in the seaborne transportation of clean petroleum products, chemicals and vegetable oils.

This will be a good stock to hold during euphoric times of economic growth, such as between 2006-2007. It's our proxy to the Baltic Dry Index. However, its share price has been beaten down since the past 2 years and its now even lower than its 2008 low (unadjusted). For the past year, EPF has been slowly disposing the stock in the market.

Its financial condition is healthy with current ratio of 4.1 and debt-to-equity ratio of 0.05. LTD/PAT is 0.36 while cash/debt is 3.8. In terms of returns, it has a high ROE of 24% and profit margin of 87% (both based on 5 years average) and gives a dividend yield of 5% (higher in the previous few years). it is currently trading at a PE of 8 and its net assets per share is $1.63.

Being a fundamentally strong stock, I'll keep it in view of recovery of its share price. Things I will look out for are

1. consolidation in its technical chart

2. upturn in the Baltic Dry Index

3. climax of the current global economic woes

4. renewed optimism in the growth of emerging markets

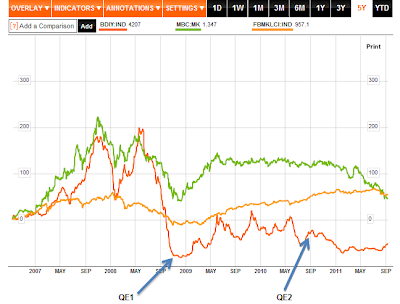

The figure below shows the effect of quantitative easing (QE) 1 on the BDI. Notice that QE 2 did not have much effect. The BDI recovery in 2009 could also be attributed to China buying up commodities which were at rock bottom prices then.

No comments:

Post a Comment