- discount from developer

- rental return- completed medium cost apartments; 7-8% pa; poor appreciation; timing not needed; tenant management

- capital appreciation - completed landed homes; poor rental return 3-5%; good appreciation 5-10%; timing important

- commercial properties (shoplots, offices) -rental 6-8% pa; good appreciation 5-10%; location important; for wealthy individuals

- raw land development

- plantation

- orchards/ecofarms

- property development

- buy basic or run-down house - refurbish

- abandoned/haunted house

- auctions

- accessibility being upgraded - OKR, Kesas, Guthrie

- area with new projects

- residential convert to commercial - main roads with conversion potential

- student accomodation - near LRT

- flipping

- bird nest farming

December 02, 2011

property investing in Malaysia

Ways to make money from property investment:

November 15, 2011

DOMINAN

Dominant Enterprise Bhd is involved in the manufacturing and trading of flat laminated and moulded wood products, targeting furniture makers and home fitting manufacturers.

Let's look at some figures for Q1FY12:

ROE and ROR is 12% and 4% respectively on a five year average basis. The ROR is on the low side, unfortunately. For comparison, it is around 12% for Evergreen and Eksons.

Revenue and profit has risen since listing in 2003. Currently, local market accounts for a major part of its revenue. It also exports to Australia, Singapore, Europe, US, Asia and other overseas market. Risks include material cost, oil price and forex risks.

From its annual report 2011: "Our strategy going forward is to identify expansion opportunities in overseas markets and to develop innovative products that cater to consumers’ tastes."

I can't find any analyst covering it, probably because of its low market capitalization.

It is undervalued according to my calculations, so I have been eyeing it for some time. It's liquidity is rather low and price has been on the downtrend since early this year. However it gives a good dividend yield, around 7%. Dividend payout around 30-40% the past few years.

Its price have been consolidating for the past 3 months. If you have bought it at 48c, now you will already have about 10% gain. I noticed it risen on some volume yesterday, so I have initiated a position in it today.

Let's look at some figures for Q1FY12:

- current ratio =1.84

- working capital - LTD = $76m

- debt/equity = 0.05

- LTD/PAT = 0.6

- cash/debt = 0.13

ROE and ROR is 12% and 4% respectively on a five year average basis. The ROR is on the low side, unfortunately. For comparison, it is around 12% for Evergreen and Eksons.

Revenue and profit has risen since listing in 2003. Currently, local market accounts for a major part of its revenue. It also exports to Australia, Singapore, Europe, US, Asia and other overseas market. Risks include material cost, oil price and forex risks.

From its annual report 2011: "Our strategy going forward is to identify expansion opportunities in overseas markets and to develop innovative products that cater to consumers’ tastes."

I can't find any analyst covering it, probably because of its low market capitalization.

It is undervalued according to my calculations, so I have been eyeing it for some time. It's liquidity is rather low and price has been on the downtrend since early this year. However it gives a good dividend yield, around 7%. Dividend payout around 30-40% the past few years.

Its price have been consolidating for the past 3 months. If you have bought it at 48c, now you will already have about 10% gain. I noticed it risen on some volume yesterday, so I have initiated a position in it today.

October 09, 2011

index investing using SMA

Let's consider 3 methods of investing based on market indices.

We use the 3 years' chart as of Oct 9, 2011 (approximate values used). 14 market indices are used.

A - buy an index when its 30 week simple moving average (SMA) crosses above the 50 week SMA and sell the index when the opposite occurs

B - buy an index when its 50 day SMA crosses above the 200 day SMA and sell the index when the opposite occurs

C - buy an index when its 50 day SMA crosses above the 200 day SMA and sell the index when the opposite occurs but with the 200d SMA turning down

Our benchmark is D, the three year return as of Oct 2011 (approximate).

We see that method B & C have the superior performance compared to A (in green). However both underperform the benchmark for 10 indices (in yellow). This is especially for the emerging markets.

However if we took 4 years instead of 3 years, the results might have been very different. Each method would probably have outperformed the benchmark since they would have avoided the bear market of 2008.

Using method B & C would yield about 10% per annum (including US) over a 3 year period. 4 markets (ASX, TW, Hang Seng and Shanghai) return less than 6% per year!

Note that if we managed to buy at the exact low and sell at the exact high (our holy grail!) would have return at least 30% per year for most of the markets.

Someone (I forgot who) recommended selling stocks (distribute) when the 30w SMA is below the 50w SMA while buying stocks (accumulate) when the opposite occurs. Based on the results above, I think using the faster moving 50d and 200d SMA would perform slightly better.

However I would also think that selling and buying gradually in such a manner would risk being equivalent to selling and then buying back at the same levels (e.g. sell at 1000, 800, 600 then buy at 600, 800 and 1000.) especially if the index moved sideways in the longer term.

Better of course would be sell mostly in the beginning of the bear and buy mostly at the start of the bull (based on the SMA). The risk to this would be too short bull and bear duration or sideways market in which case the commission will be costly.

We use the 3 years' chart as of Oct 9, 2011 (approximate values used). 14 market indices are used.

A - buy an index when its 30 week simple moving average (SMA) crosses above the 50 week SMA and sell the index when the opposite occurs

B - buy an index when its 50 day SMA crosses above the 200 day SMA and sell the index when the opposite occurs

C - buy an index when its 50 day SMA crosses above the 200 day SMA and sell the index when the opposite occurs but with the 200d SMA turning down

Our benchmark is D, the three year return as of Oct 2011 (approximate).

We see that method B & C have the superior performance compared to A (in green). However both underperform the benchmark for 10 indices (in yellow). This is especially for the emerging markets.

However if we took 4 years instead of 3 years, the results might have been very different. Each method would probably have outperformed the benchmark since they would have avoided the bear market of 2008.

Using method B & C would yield about 10% per annum (including US) over a 3 year period. 4 markets (ASX, TW, Hang Seng and Shanghai) return less than 6% per year!

Note that if we managed to buy at the exact low and sell at the exact high (our holy grail!) would have return at least 30% per year for most of the markets.

Someone (I forgot who) recommended selling stocks (distribute) when the 30w SMA is below the 50w SMA while buying stocks (accumulate) when the opposite occurs. Based on the results above, I think using the faster moving 50d and 200d SMA would perform slightly better.

However I would also think that selling and buying gradually in such a manner would risk being equivalent to selling and then buying back at the same levels (e.g. sell at 1000, 800, 600 then buy at 600, 800 and 1000.) especially if the index moved sideways in the longer term.

Better of course would be sell mostly in the beginning of the bear and buy mostly at the start of the bull (based on the SMA). The risk to this would be too short bull and bear duration or sideways market in which case the commission will be costly.

October 05, 2011

ICAP Investor Day 2011

icapital.biz held the Investor Day 2011 in conjunction with its AGM at the KL Convention Center. I share some takeways from the talks from the captains of the industry.

(Too bad I didn't have my DSLR with me, otherwise I can post some pictures. Anyone care to donate their unwanted handphone camera to me?)

Ex-CEO of F&N Dato Tan Ang Meng:

- the 4 largest beverage manufacturers in Malaysia now are F&N, Permanis, Coca-Cola and Yeo Hiap Seng (in descending order.)

- carbonated drinks margin is highest at 15% compared to others (Asian drinks, juice) but its market share is going down especially in developed countries (for health awareness reasons) but it still has growth potential in developing countries like China and India

- Japan (Asahi, Suntory, Sapporo, Kirin) is expanding overseas due to their demographics (older population lesser consumption)

- status quo will remain for the moment for Permanis before Asahi starts introducing new products

F&N 100 plus is a large contributor to its revenue while its condensed milk sales are resilient (thanks to teh tarik stalls)

- values F&N at $7.3b (based on Permanis acquisition) but he thinks Permanis was overvalued while F&N is slightly undervalued due to the pessimism over losing its Coke licensing

- Coca-Cola (just went its own way here) is seen as a threat but will be struggling in the next few years, which is an opportunity for F&N to capitalize on with its large distribution network

- YHS is a good takeover target

CFO of Petronas Dagangan Rozaini Musa:

- Petdag is #1 in the commercial (supplying to airplanes, industries) and LPG (cooking gas)segment and #2 in retail (petrol stations, after Shell) and lubricants.

- retail still has room to expand while there are plans to expand abroad to Thailand and Indonesia

starting to sell LPG through petrol stations

CEO of Malaysia Smelting Corporation Dato Seri Mohd Ajib Anuar ("The tin man"):

- MSC is the 2nd largest tin metal supplier in the world

- tin is mostly used in electronics at the moment (for soldering) besides tin plates for packaging but has also many other uses and is non toxic

- price volatility is due to its securatization leading to speculative activities

- for smeltering, earnings are on a cost plus basis while for mining it is correlated to the price of tin itself

- US used to keep a large stockpile but now not anymore

- MSC losses in 2010 was due to divestment of its non-tin assets causing impairment

- MSC now intends to focus on tin only, thus earnings will be more stable going forward and plans to develop new mines abroad

As for Tan Teng Boo's view:

- he is bearish on 2H2011 since early part of the year

- although there may be another global recession, which will be worst than in 2008, global economic depression is unlikely due to the growth of emerging markets (none in 1930s)

- problem is worst now compared to 2008 because governments of developed nations have run out of policy tools (interest rates are near 0%) while developing nations are suffering from high inflation

- Malaysian economic outlook in the long term depends a lot on whether the promised economic reforms will take place

Padini held a fashion show with many pretty, slim models. If I could bring home that tall, long haired Eastern European (?) girl, now that would be a fantastic takeway :P

(Too bad I didn't have my DSLR with me, otherwise I can post some pictures. Anyone care to donate their unwanted handphone camera to me?)

Ex-CEO of F&N Dato Tan Ang Meng:

- the 4 largest beverage manufacturers in Malaysia now are F&N, Permanis, Coca-Cola and Yeo Hiap Seng (in descending order.)

- carbonated drinks margin is highest at 15% compared to others (Asian drinks, juice) but its market share is going down especially in developed countries (for health awareness reasons) but it still has growth potential in developing countries like China and India

- Japan (Asahi, Suntory, Sapporo, Kirin) is expanding overseas due to their demographics (older population lesser consumption)

- status quo will remain for the moment for Permanis before Asahi starts introducing new products

F&N 100 plus is a large contributor to its revenue while its condensed milk sales are resilient (thanks to teh tarik stalls)

- values F&N at $7.3b (based on Permanis acquisition) but he thinks Permanis was overvalued while F&N is slightly undervalued due to the pessimism over losing its Coke licensing

- Coca-Cola (just went its own way here) is seen as a threat but will be struggling in the next few years, which is an opportunity for F&N to capitalize on with its large distribution network

- YHS is a good takeover target

CFO of Petronas Dagangan Rozaini Musa:

- Petdag is #1 in the commercial (supplying to airplanes, industries) and LPG (cooking gas)segment and #2 in retail (petrol stations, after Shell) and lubricants.

- retail still has room to expand while there are plans to expand abroad to Thailand and Indonesia

starting to sell LPG through petrol stations

CEO of Malaysia Smelting Corporation Dato Seri Mohd Ajib Anuar ("The tin man"):

- MSC is the 2nd largest tin metal supplier in the world

- tin is mostly used in electronics at the moment (for soldering) besides tin plates for packaging but has also many other uses and is non toxic

- price volatility is due to its securatization leading to speculative activities

- for smeltering, earnings are on a cost plus basis while for mining it is correlated to the price of tin itself

- US used to keep a large stockpile but now not anymore

- MSC losses in 2010 was due to divestment of its non-tin assets causing impairment

- MSC now intends to focus on tin only, thus earnings will be more stable going forward and plans to develop new mines abroad

As for Tan Teng Boo's view:

- he is bearish on 2H2011 since early part of the year

- although there may be another global recession, which will be worst than in 2008, global economic depression is unlikely due to the growth of emerging markets (none in 1930s)

- problem is worst now compared to 2008 because governments of developed nations have run out of policy tools (interest rates are near 0%) while developing nations are suffering from high inflation

- Malaysian economic outlook in the long term depends a lot on whether the promised economic reforms will take place

Padini held a fashion show with many pretty, slim models. If I could bring home that tall, long haired Eastern European (?) girl, now that would be a fantastic takeway :P

October 02, 2011

ICAP AGM 2011

icapital.biz held its FY2011 AGM yesterday at the KL Convention Center. icapital.biz is a closed end fund of Malaysian stocks managed by Tan Teng Boo.

This year's main issue during the AGM was whether buy back shares of the company due to its persistent undervaluation by the market since the global financial crisis (it has been trading at a discount of around 20% to its nett asset value.) As Warren Buffett has announced that Berkshire Hathaway intends to buy back shares for the first time in its history, icap has also been evaluating this.

The investors were given a presentation of the pros and cons of a buyback. From their analysis, a share buyback followed by cancellation of the shares will only have at most a 2% effect of increasing its NAV. In Malaysia, the maximum amount of share buyback is 10% of the shares. A share buyback may temporarily reduce the fund's undervaluation but there is no guarantee that this effect will be long-lasting since the buyback is a one time event. This has been proved by some case studies research in the US.

The other option would be to sell the shares later after the price goes up. This is not good either but I forgot what was their reason (because I did not take notes)... I think it was because this action is unfair to the long term investors in the fund. Maybe it is like giving some of the cash to those who want to opt out of the fund later at the expense of others. Also, the anticipation that the shares will be sold later will depress the price of the fund. To me, it doesn't seem ethical for the fund to do so, as it would penalize those who sold at below NAV either out of desperation or ignorance.

But then, if done at a continued basis, it could serve as a stabilizer to ensure the fund always trades near its NAV. Imagine such a policy being announced, then on the next trading day nobody would sell at below NAV (assuming everybody was well informed). The only sellers are the traders who think the price will go down more. Similarly nobody would sell above NAV except traders. This however may be impractical due to the 10% limit. And maybe it will lead to potential manipulation?

A share buyback will reduce the cash balance of the fund (by about $30m to $85m, my estimate based on its annual report.) That will reduce the ammunition the fund has to buy some cheap undervalued stocks when the opportunity arrives. This is the option preferred by the fund manager.

The fund's analyst (all their analysts sound and look like fresh university graduates) also highlighted the difference between a company and closed end fund share buyback. If a company buys back all its shares, its taking itself private but its business still continues to generate profit for the company. When a closed end fund buys back shares, it is amounting to liquidating itself.

As a comparison, Berkshire has traded at a premium which has reduced over the years until now it is near 1.1x NAV. Warren Buffett recently announced they will buy back shares at below 1.1x NAV. No one seems to be sure of his reasons, perhaps he is just trying to signal his confidence in the US economy.

The other issue, which always crops up, is the request to pay dividends. The manager says a firm no to this as it is against the fund's original objective.

To be noted, local retail investors have been selling the fund (based on the decreasing number of shareholders) but some foreign investor have been buying in the past year. 5 foreign investors are among the top 30 largest shareholders.

Well, whatever action taken it depends on the objective. If you want to cash out, then you would want the fund to buy back so you can sell at close to the NAV (or you hope many new investors will come in so that the discount starts decreasing). If you believe in long term capital appreciation, which is the objective of the fund, then you prefer the fund use its cash to buy more undervalued stocks later (and you buy more of the fund while its at a discount). If you want to wait and see, then you wait for the fund to trade at a premium and then consider selling (but when that happens, you'll probably hesitate, right :P)

This year's main issue during the AGM was whether buy back shares of the company due to its persistent undervaluation by the market since the global financial crisis (it has been trading at a discount of around 20% to its nett asset value.) As Warren Buffett has announced that Berkshire Hathaway intends to buy back shares for the first time in its history, icap has also been evaluating this.

The investors were given a presentation of the pros and cons of a buyback. From their analysis, a share buyback followed by cancellation of the shares will only have at most a 2% effect of increasing its NAV. In Malaysia, the maximum amount of share buyback is 10% of the shares. A share buyback may temporarily reduce the fund's undervaluation but there is no guarantee that this effect will be long-lasting since the buyback is a one time event. This has been proved by some case studies research in the US.

The other option would be to sell the shares later after the price goes up. This is not good either but I forgot what was their reason (because I did not take notes)... I think it was because this action is unfair to the long term investors in the fund. Maybe it is like giving some of the cash to those who want to opt out of the fund later at the expense of others. Also, the anticipation that the shares will be sold later will depress the price of the fund. To me, it doesn't seem ethical for the fund to do so, as it would penalize those who sold at below NAV either out of desperation or ignorance.

But then, if done at a continued basis, it could serve as a stabilizer to ensure the fund always trades near its NAV. Imagine such a policy being announced, then on the next trading day nobody would sell at below NAV (assuming everybody was well informed). The only sellers are the traders who think the price will go down more. Similarly nobody would sell above NAV except traders. This however may be impractical due to the 10% limit. And maybe it will lead to potential manipulation?

A share buyback will reduce the cash balance of the fund (by about $30m to $85m, my estimate based on its annual report.) That will reduce the ammunition the fund has to buy some cheap undervalued stocks when the opportunity arrives. This is the option preferred by the fund manager.

The fund's analyst (all their analysts sound and look like fresh university graduates) also highlighted the difference between a company and closed end fund share buyback. If a company buys back all its shares, its taking itself private but its business still continues to generate profit for the company. When a closed end fund buys back shares, it is amounting to liquidating itself.

As a comparison, Berkshire has traded at a premium which has reduced over the years until now it is near 1.1x NAV. Warren Buffett recently announced they will buy back shares at below 1.1x NAV. No one seems to be sure of his reasons, perhaps he is just trying to signal his confidence in the US economy.

The other issue, which always crops up, is the request to pay dividends. The manager says a firm no to this as it is against the fund's original objective.

To be noted, local retail investors have been selling the fund (based on the decreasing number of shareholders) but some foreign investor have been buying in the past year. 5 foreign investors are among the top 30 largest shareholders.

Well, whatever action taken it depends on the objective. If you want to cash out, then you would want the fund to buy back so you can sell at close to the NAV (or you hope many new investors will come in so that the discount starts decreasing). If you believe in long term capital appreciation, which is the objective of the fund, then you prefer the fund use its cash to buy more undervalued stocks later (and you buy more of the fund while its at a discount). If you want to wait and see, then you wait for the fund to trade at a premium and then consider selling (but when that happens, you'll probably hesitate, right :P)

September 18, 2011

bearish flag

September 15, 2011

news bits

World Bank President Robert Zoellick said on Wednesday the world had entered a new economic danger zone and Europe, Japan and the United States all needed to make hard decisions to avoid dragging down the global economy....Zoellick said European countries were resisting difficult truths about their common responsibilities, Japan had held off on needed economic and social reforms, and political differences in the United States were overshadowing efforts to cut record budget deficits. (Reuters)

Carl Weinberg, the chief economist at High Frequency Economics is very worried about Europe. His central forecast is that the debt crisis will lead Europe into a depression that will mean soaring unemployment, deflation and zero interest rates for the foreseeable future....Gold will offer the safest haven, according to Weinberg, who fully expects Europeans to move cash under their mattresses in early phases of this crisis...."The beneficiaries of this flight of cash out of Euroland will be the hot economies of Asia, notably China, India and Korea." said Weinberg. (CNBC)

Food prices could rise next year because an unseasonably hot summer likely damaged much of this year's corn crop....More expensive corn drives food prices higher because corn is an ingredient in everything from animal feed to cereal to soft drinks. It takes about six months for corn prices to trickle down to products at the grocery store. (AP)

All Malaysian gasoline stations will offer bio-diesel fuel by next year, Plantation Industries and Commodities Minister Bernard Dompok told reporters. (Bloomberg)

Carl Weinberg, the chief economist at High Frequency Economics is very worried about Europe. His central forecast is that the debt crisis will lead Europe into a depression that will mean soaring unemployment, deflation and zero interest rates for the foreseeable future....Gold will offer the safest haven, according to Weinberg, who fully expects Europeans to move cash under their mattresses in early phases of this crisis...."The beneficiaries of this flight of cash out of Euroland will be the hot economies of Asia, notably China, India and Korea." said Weinberg. (CNBC)

Food prices could rise next year because an unseasonably hot summer likely damaged much of this year's corn crop....More expensive corn drives food prices higher because corn is an ingredient in everything from animal feed to cereal to soft drinks. It takes about six months for corn prices to trickle down to products at the grocery store. (AP)

All Malaysian gasoline stations will offer bio-diesel fuel by next year, Plantation Industries and Commodities Minister Bernard Dompok told reporters. (Bloomberg)

September 13, 2011

MAYBULK

Malaysian Bulk Carriers Bhd. is the largest drybulk shipowner in Malaysia engaged in international shipping. It presently owns and operates a fleet of vessels which includes dry bulk carriers and product tankers. Bulk carriers are involved in the transportation of dry cargoes comprising major bulks such as iron ore, coal, grains and minor bulks like sugar, coke, fertilisers. Tankers are engaged primarily in the seaborne transportation of clean petroleum products, chemicals and vegetable oils.

This will be a good stock to hold during euphoric times of economic growth, such as between 2006-2007. It's our proxy to the Baltic Dry Index. However, its share price has been beaten down since the past 2 years and its now even lower than its 2008 low (unadjusted). For the past year, EPF has been slowly disposing the stock in the market.

Its financial condition is healthy with current ratio of 4.1 and debt-to-equity ratio of 0.05. LTD/PAT is 0.36 while cash/debt is 3.8. In terms of returns, it has a high ROE of 24% and profit margin of 87% (both based on 5 years average) and gives a dividend yield of 5% (higher in the previous few years). it is currently trading at a PE of 8 and its net assets per share is $1.63.

Being a fundamentally strong stock, I'll keep it in view of recovery of its share price. Things I will look out for are

1. consolidation in its technical chart

2. upturn in the Baltic Dry Index

3. climax of the current global economic woes

4. renewed optimism in the growth of emerging markets

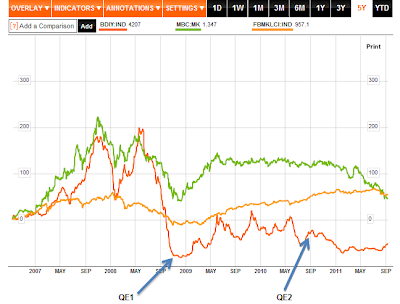

The figure below shows the effect of quantitative easing (QE) 1 on the BDI. Notice that QE 2 did not have much effect. The BDI recovery in 2009 could also be attributed to China buying up commodities which were at rock bottom prices then.

This will be a good stock to hold during euphoric times of economic growth, such as between 2006-2007. It's our proxy to the Baltic Dry Index. However, its share price has been beaten down since the past 2 years and its now even lower than its 2008 low (unadjusted). For the past year, EPF has been slowly disposing the stock in the market.

Its financial condition is healthy with current ratio of 4.1 and debt-to-equity ratio of 0.05. LTD/PAT is 0.36 while cash/debt is 3.8. In terms of returns, it has a high ROE of 24% and profit margin of 87% (both based on 5 years average) and gives a dividend yield of 5% (higher in the previous few years). it is currently trading at a PE of 8 and its net assets per share is $1.63.

Being a fundamentally strong stock, I'll keep it in view of recovery of its share price. Things I will look out for are

1. consolidation in its technical chart

2. upturn in the Baltic Dry Index

3. climax of the current global economic woes

4. renewed optimism in the growth of emerging markets

The figure below shows the effect of quantitative easing (QE) 1 on the BDI. Notice that QE 2 did not have much effect. The BDI recovery in 2009 could also be attributed to China buying up commodities which were at rock bottom prices then.

September 05, 2011

market views

Views collected from the MoneyWeek magazine:

John Stepek advises there core holdings for the long term - gold, blue chips with dividend yields and cash.

Dominic Frisby believes we’re now in a bear market and that rallies should be sold. This is based on the Death Cross signal on the SP500 and FTSE charts - both moving averages sloping down as the 50 dma crossed the 200 dma. Since 1996, this has only happened twice- in late 2000 and early 2008. Both were times to get out of the stock market.

Simon Caufield sees a temporary recovery of the economy this year before recession hits in 2012. He advises holding free cash in your portfolio and prepare to catch once-in-a-generation opportunities next year.

John Stepek advises there core holdings for the long term - gold, blue chips with dividend yields and cash.

Dominic Frisby believes we’re now in a bear market and that rallies should be sold. This is based on the Death Cross signal on the SP500 and FTSE charts - both moving averages sloping down as the 50 dma crossed the 200 dma. Since 1996, this has only happened twice- in late 2000 and early 2008. Both were times to get out of the stock market.

Simon Caufield sees a temporary recovery of the economy this year before recession hits in 2012. He advises holding free cash in your portfolio and prepare to catch once-in-a-generation opportunities next year.

August 29, 2011

news bits

The hottest summer since 1955 in Iowa and Illinois is eroding yield prospects for corn and soybean crops in the U.S., the largest grower and exporter. Signs of diminished output appeared this week during a four-day, seven-state sampling of about 2,000 fields in the Midwest organized by the Professional Farmers of America, which will report its findings later today. A Bloomberg survey of 25 tour participants showed all expected the government to cut its corn-harvest forecasts and 21 predicted a reduction for soybeans. (Bloomberg)

World wheat production will be 0.4 percent higher than a July estimate at 677 million metric tons on better production in the European Union, Russia and China, the International Grains Council said yesterday. The EU estimate was increased 0.5 percent to 137.5 million tons. (Bloomberg)

The new head of the IMF on Saturday, Aug 27 called on global policymakers to pursue urgent action, including forcing European banks to bulk up their capital, to prevent a descent into a renewed world recession...."Monetary policy also should remain highly accommodative, as the risk of recession outweighs the risk of inflation," Lagarde said, adding that central banks should stand ready to jump back into unconventional policy actions if needed. (Reuters)

The U.S. won’t slip into recession after Federal Reserve Chairman Ben S. Bernanke said the central bank has more tools to support growth if needed, said Templeton Asset Management’s Mark Mobius....Mobius is positive on commodity stocks and expects higher raw-material prices as inflation accelerates...He is “pretty positive” about Southeast Asian equity markets, he added. “Looking at Southeast Asia, it’s Thailand and Indonesia.” (Bloomberg)

World wheat production will be 0.4 percent higher than a July estimate at 677 million metric tons on better production in the European Union, Russia and China, the International Grains Council said yesterday. The EU estimate was increased 0.5 percent to 137.5 million tons. (Bloomberg)

The new head of the IMF on Saturday, Aug 27 called on global policymakers to pursue urgent action, including forcing European banks to bulk up their capital, to prevent a descent into a renewed world recession...."Monetary policy also should remain highly accommodative, as the risk of recession outweighs the risk of inflation," Lagarde said, adding that central banks should stand ready to jump back into unconventional policy actions if needed. (Reuters)

The U.S. won’t slip into recession after Federal Reserve Chairman Ben S. Bernanke said the central bank has more tools to support growth if needed, said Templeton Asset Management’s Mark Mobius....Mobius is positive on commodity stocks and expects higher raw-material prices as inflation accelerates...He is “pretty positive” about Southeast Asian equity markets, he added. “Looking at Southeast Asia, it’s Thailand and Indonesia.” (Bloomberg)

August 23, 2011

13 Reasons to Invest in Wellcall

I made this list based on an article about Wellcall in The Edge Malaysia yesterday.

13 Reasons to Invest in Wellcall:

1. It is the largest exporter of industrial rubber hoses in Malaysia

2. It is able to pass down the cost to customers if raw material prices (rubber) rises gradually

3. It has the flexibility to switch between natural and synthetic rubber

4. 98% of transactions are in US dollars (advantageous if the US dollar strengthens)

5. Its operations are capital intensive rather than labour intensive, with a workforce of only 400.

6. Its products are more for niche markets, especially in the oil and gas (O&G) sector. Other major application markets include automobile, ship building, mining and food and beverage (F&B).

7. It has no significant competitors in Malaysia due to high cost of equipment.

8. Its current production utilisation is reaching 80% and planning to expand.

9. It derives 90% of its revenue derived from foreign markets, i.e. Asia, Middle East, Europe, North America, Australia/New Zealand and South America. It is expanding its customer base in places such as Africa, Russia and Latin America.

10. 85% to 90% of its sales come from the replacement market because industrial hoses last up to eight months before they are replaced.

11. It does not hold stock of its products because production is based on a job order basis, thus preventing overcapacity and price dumping.

12. The market for industrial hoses has a growth of 4% to 5% a year.

13. High dividend yields and debt free

I like reasons No. 7, 8, 10, 13.

Main risks would be 4 and 9.

Its share in global market is only 0.4%.

Its website comes out in the first page of Google when I searched the term "industrial rubber hoses."

It would be a good buy if the global economy is expanding.

13 Reasons to Invest in Wellcall:

1. It is the largest exporter of industrial rubber hoses in Malaysia

2. It is able to pass down the cost to customers if raw material prices (rubber) rises gradually

3. It has the flexibility to switch between natural and synthetic rubber

4. 98% of transactions are in US dollars (advantageous if the US dollar strengthens)

5. Its operations are capital intensive rather than labour intensive, with a workforce of only 400.

6. Its products are more for niche markets, especially in the oil and gas (O&G) sector. Other major application markets include automobile, ship building, mining and food and beverage (F&B).

7. It has no significant competitors in Malaysia due to high cost of equipment.

8. Its current production utilisation is reaching 80% and planning to expand.

9. It derives 90% of its revenue derived from foreign markets, i.e. Asia, Middle East, Europe, North America, Australia/New Zealand and South America. It is expanding its customer base in places such as Africa, Russia and Latin America.

10. 85% to 90% of its sales come from the replacement market because industrial hoses last up to eight months before they are replaced.

11. It does not hold stock of its products because production is based on a job order basis, thus preventing overcapacity and price dumping.

12. The market for industrial hoses has a growth of 4% to 5% a year.

13. High dividend yields and debt free

I like reasons No. 7, 8, 10, 13.

Main risks would be 4 and 9.

Its share in global market is only 0.4%.

Its website comes out in the first page of Google when I searched the term "industrial rubber hoses."

It would be a good buy if the global economy is expanding.

August 20, 2011

Faber favours Asia

According to a MarketWatch article, Dr.Marc Faber favours emerging market equities and corporate bonds for the long term, and also gold.

"Faber's own stock portfolio is centered on dividend-paying Asian shares, particularly in Malaysia, Singapore, Thailand and Hong Kong. These include a variety of real estate investment trusts and utilities....he's also turned positive on Japanese banks, brokerages and insurance companies....Faber is convinced that the price of gold will continue rising and that any pullback is a buying opportunity."

"Faber's own stock portfolio is centered on dividend-paying Asian shares, particularly in Malaysia, Singapore, Thailand and Hong Kong. These include a variety of real estate investment trusts and utilities....he's also turned positive on Japanese banks, brokerages and insurance companies....Faber is convinced that the price of gold will continue rising and that any pullback is a buying opportunity."

August 18, 2011

Hup Seng

Hup Seng Industries Bhd. is involved in manufacturing and trading of biscuit and beverage (Incomix brand coffee). Besides the domestic market, it also exports it products to over 40 countries in Asia, USA, Russia and Africa. Overseas market accounts for almost 30% of its revenue in FY2009 (no information given for FY2010.)

The ratios I look at (refer to my earlier post).)indicates it is in good financial health. The company has no borrowings.

current ratio = 3.2

working capital - LTD = $75.25m

DE ratio = 0.058

LTD/PAT = 0.37

cash/debt = 1.27

5 year historical average ROE and ROR is 11% and 7% respectively. Revenue and earnings have grown compared to 5 years ago. Profit margin improved significantly in 2008 onwards compared to 2004-07, perhaps due to the crash in commodity prices. The company paid at least 10 cents per share of dividend annually since FY2005. It is already paying dividends totalling 10 cents for FY2011.

Risks to it profitability include raw material cost (palm oil, wheat, fuel) and the government’s gradual withdrawal of subsidies.

It's share is currently trading at a PE ratio of 8.9.

The ratios I look at (refer to my earlier post).)indicates it is in good financial health. The company has no borrowings.

current ratio = 3.2

working capital - LTD = $75.25m

DE ratio = 0.058

LTD/PAT = 0.37

cash/debt = 1.27

5 year historical average ROE and ROR is 11% and 7% respectively. Revenue and earnings have grown compared to 5 years ago. Profit margin improved significantly in 2008 onwards compared to 2004-07, perhaps due to the crash in commodity prices. The company paid at least 10 cents per share of dividend annually since FY2005. It is already paying dividends totalling 10 cents for FY2011.

Risks to it profitability include raw material cost (palm oil, wheat, fuel) and the government’s gradual withdrawal of subsidies.

It's share is currently trading at a PE ratio of 8.9.

August 16, 2011

news bits

The Pekeliling flats area, located along Jalan Tun Razak-Jalan Pahang is to be redeveloped. Now known as Tamansari Riverside Garden City, its developer Asie Sdn Bhd has awarded Mah Sing a contract to build properties for RM900 million. Asie expects to award two more contracts by year-end to build properties worth over RM1 billion. The project has supposedly been put on hold thrice (1976, 1997 and 2008.) (Source: Business Times)

Comment: I hope they look into the traffic congestion problem first.

The business outlook for shipping firms in Asia-Pacific remains weak because of continuing transportation supply exceeding demand. In a statement today, Standard & Poor (S&P) said high fuel prices and economic uncertainties, coupled with other factors such as overcapacity, would continue to hinder the recovery of the main shipping sectors in the region and globally. (source: Bernama)

Comment: This could be favourable for logistics companies.

Chief Minister Tan Sri Abdul Taib Mahmud said today that the Sarawak government hopes to attract at least RM200 billion in private investments for the Sarawak Corridor of Renewable Energy (SCORE) over the next 20 years. RM26.4 billion worth of investments in 13 projects have been approved so far.(source: Bernama)

Comment: This one is sweetener for coming elections or can really score big ?

Comment: I hope they look into the traffic congestion problem first.

The business outlook for shipping firms in Asia-Pacific remains weak because of continuing transportation supply exceeding demand. In a statement today, Standard & Poor (S&P) said high fuel prices and economic uncertainties, coupled with other factors such as overcapacity, would continue to hinder the recovery of the main shipping sectors in the region and globally. (source: Bernama)

Comment: This could be favourable for logistics companies.

Chief Minister Tan Sri Abdul Taib Mahmud said today that the Sarawak government hopes to attract at least RM200 billion in private investments for the Sarawak Corridor of Renewable Energy (SCORE) over the next 20 years. RM26.4 billion worth of investments in 13 projects have been approved so far.(source: Bernama)

Comment: This one is sweetener for coming elections or can really score big ?

August 15, 2011

MRT project

The table below shows the public listed companies shortlisted (marked with blue) for the Mass Rapid Transit (MRT) project in Klang Valley. There are a total of 18 packages (the numbers shown in each category)- 8 for elevated civil works, 8 for stations and 2 for depots. The tenders for the multi-billion public transportation project would be called in stages beginning from next month until December 2012. This will be Malaysia's biggest rail infrastructure project, which would be integrated to the existing LRT, Monorail and KTM services.

(*There are other shortlisted companies or joint ventures which to my knowledge are not subsidiaries of public listed companies.)

(*There are other shortlisted companies or joint ventures which to my knowledge are not subsidiaries of public listed companies.)

August 13, 2011

cement producers

The top 3 cement producers listed on the KLSE are LaFarge Malaysia (LMCEMNT), YTL Cement (YTLCMT) and Tasek (TASEK). LMCEMNT has the largest market capitalization and revenue, followed by YTLCMT and TASEK. However, YTLCMT actually currently makes more profit than LMCEMNT, based on the rolling profit of the previous 4 quarters. LMCEMNT is a subsidiary of the world's biggest cement maker Lafarge SA, traded on the Paris bourse.

The following table compares them (using data from the lastest quarterly and annual reports.)

It can be seen that both YTLCMT and TASEK fulfill all our 5 criteria of financial strength (see my previous post). YTLCMT has the highest return on equity (ROE) while TASEK has the highest return on revenue (ROR). Note that both these figures are 5 year averages.

TASEK tends to have the lower historical PE ratio,perhaps due to its low trading volume and liquidity. The company is a subsidiary of Hong Leong Asia (which is owned by Tan Sri Quek), which holds something like 72% of the shares.

At current stock prices, YTLCMT and TASEK are trading below their average historical PE ratio. However TASEK had a gain on disposal of property amounting to 43m in 4QFY10. Without this one-time gain, it is trading at its historical average PER.

The catalyst for cement producers would be construction activities from the ETP govt projects. Risks include ceiling price by government and energy costs (coal, electricity, diesel).

As I am only sharing information, I will not make any recommendations. I also make no guarantee to the accuracy of the information given.

*Note that the historical PE ratio is calculated based on the financial year end's closing price.

The following table compares them (using data from the lastest quarterly and annual reports.)

It can be seen that both YTLCMT and TASEK fulfill all our 5 criteria of financial strength (see my previous post). YTLCMT has the highest return on equity (ROE) while TASEK has the highest return on revenue (ROR). Note that both these figures are 5 year averages.

TASEK tends to have the lower historical PE ratio,perhaps due to its low trading volume and liquidity. The company is a subsidiary of Hong Leong Asia (which is owned by Tan Sri Quek), which holds something like 72% of the shares.

At current stock prices, YTLCMT and TASEK are trading below their average historical PE ratio. However TASEK had a gain on disposal of property amounting to 43m in 4QFY10. Without this one-time gain, it is trading at its historical average PER.

The catalyst for cement producers would be construction activities from the ETP govt projects. Risks include ceiling price by government and energy costs (coal, electricity, diesel).

As I am only sharing information, I will not make any recommendations. I also make no guarantee to the accuracy of the information given.

*Note that the historical PE ratio is calculated based on the financial year end's closing price.

August 11, 2011

market view

According to Hong Leong Investment Bank's latest Market View report today, their FBM KLCI year-end target of 1,670 (15x 2012 earnings) is "at risk with downside bias in view of risk aversion and potential global recession." It is noted however that Asia is facing this from a "position of strength given room for monetary loosening, ample liquidity, strong banking system and rising consumerism amidst reducing inflationary threat."

For investors who want to remain invested, they recommend defensive stocks such as Public Bank, Axiata, Digi, TM, Maxis, KLCCP, BJToto and Boustead as well as some high dividend yield stocks and REITs.

For investors who want to remain invested, they recommend defensive stocks such as Public Bank, Axiata, Digi, TM, Maxis, KLCCP, BJToto and Boustead as well as some high dividend yield stocks and REITs.

August 09, 2011

Target price

When is a stock considered cheap and when is it expensive? What is the intrinsic value of a company's stock?

When I first started out, I struggled with this concept. Many investors use different method of finding the intrinsic value. It is actually quite subjective and even Warren Buffett does not reveal how he arrives at the value of a company.

As retail investors, we love to find research reports where the target price is given. However we should beware of how the target price is arrived in most cases.

Most research analysts will give a target value based on the price-to-earnings ratio (PER) of a company. For example, the analyst takes the average PE ratio of the company over a period of time, say over 5 years. Then according to the predicted earnings (eps) at the end of FY13, for example, the target price is arrived. So if the average PE ratio is 15 and eps for FY13 is estimated to be $0.10, then the target price is 15 x $0.10 = $1.50.

We immediately see the potential problem here- the earnings estimate may be too optimistic. Or it may assume a blue sky scenario. If a black swan suddenly emerges, there will be a cut in the earnings estimate, and target price is reduced. You bought the stock last week with a potential 30% upside, suddenly new research report comes out and you are suddenly told that you should sell!

Rather than taking the average PE, some analyst may even take the PE at the high end. For example, if a stock's PE ranges from 12-18 in the past few years, the analyst may take a higher value of 16 or even 18.

When I first started out, I struggled with this concept. Many investors use different method of finding the intrinsic value. It is actually quite subjective and even Warren Buffett does not reveal how he arrives at the value of a company.

As retail investors, we love to find research reports where the target price is given. However we should beware of how the target price is arrived in most cases.

Most research analysts will give a target value based on the price-to-earnings ratio (PER) of a company. For example, the analyst takes the average PE ratio of the company over a period of time, say over 5 years. Then according to the predicted earnings (eps) at the end of FY13, for example, the target price is arrived. So if the average PE ratio is 15 and eps for FY13 is estimated to be $0.10, then the target price is 15 x $0.10 = $1.50.

We immediately see the potential problem here- the earnings estimate may be too optimistic. Or it may assume a blue sky scenario. If a black swan suddenly emerges, there will be a cut in the earnings estimate, and target price is reduced. You bought the stock last week with a potential 30% upside, suddenly new research report comes out and you are suddenly told that you should sell!

Rather than taking the average PE, some analyst may even take the PE at the high end. For example, if a stock's PE ranges from 12-18 in the past few years, the analyst may take a higher value of 16 or even 18.

August 08, 2011

Added HUPSENG and BJTOTO

Today I added to my BJTOTO holdings at $4.10 and bought into HUPSENG at $1.72.

Berjaya Toto is in the gaming sector and is basically a dividend stock.

Hup Seng Food Industries manufactures biscuits, cookies and crackers as well as a coffee manufacturing division. Around 70% revenue is derived from domestic sales (as at FY2009). It has a 60% dividend policy, as far as I know. Based on its FY2010 annual report, it has no short term loans and only $8.6m of non-current liabilities with a cash pile of $54m.

Berjaya Toto is in the gaming sector and is basically a dividend stock.

Hup Seng Food Industries manufactures biscuits, cookies and crackers as well as a coffee manufacturing division. Around 70% revenue is derived from domestic sales (as at FY2009). It has a 60% dividend policy, as far as I know. Based on its FY2010 annual report, it has no short term loans and only $8.6m of non-current liabilities with a cash pile of $54m.

Large red bars

Many stocks gapped down when today's market opened in Malaysia, and we'll probably end up with a large red candlestick bar in the charts at the end of the day. S&P downgraded US debt to AA+ on Friday.

I am rather peeved that some of my paper profits that took some months to build have been wiped out or reduced drastically in a day.

My current forecast is that we'll have a 20-30% correction in the KLCI for 2H2011 i.e. it will be a downward bias market for the rest of the year, until we have some fresh catalyst. This will be a good time to accumulate some good quality dividend yielding stocks, while I'll try to unload some of my more vulnerable, speculative stocks if I am able to make a small profit on them. Otherwise I'll keep them for the long term. I know some traders would say to cut loss, cut loss, cut loss. But I know the stocks I have are companies that are financially strong and can survive a downturn (and have survived the last downturn). So I am comfortable with the temporary illiquidity.

It's time like these that knowing the financial condition of your company becomes more important so that you don't simply sell your good quality stocks in panic selling.

According to Macquarie, the US debt downgrade will benefit Malaysia and Singapore bonds.

"Singapore and Malaysia will be the main beneficiaries of inflows into the region as global funds step up diversification into non-dollar assets after the US lost its top credit rating, according to Macquarie Group Ltd.

International investors will add to holdings of Singapore bonds, the only economy in Southeast Asia with a top rating from Standard & Poor’s, Moody’s Investors Service and Fitch Ratings, the bank said in a research note dated Aug. 6. Malaysia, which has the world’s largest Islamic debt market, will become more attractive to investors in the Middle East, according to Australia’s biggest investment bank."- Bloomberg

Read more: US downgrade to benefit Malaysia: Macquarie

I am rather peeved that some of my paper profits that took some months to build have been wiped out or reduced drastically in a day.

My current forecast is that we'll have a 20-30% correction in the KLCI for 2H2011 i.e. it will be a downward bias market for the rest of the year, until we have some fresh catalyst. This will be a good time to accumulate some good quality dividend yielding stocks, while I'll try to unload some of my more vulnerable, speculative stocks if I am able to make a small profit on them. Otherwise I'll keep them for the long term. I know some traders would say to cut loss, cut loss, cut loss. But I know the stocks I have are companies that are financially strong and can survive a downturn (and have survived the last downturn). So I am comfortable with the temporary illiquidity.

It's time like these that knowing the financial condition of your company becomes more important so that you don't simply sell your good quality stocks in panic selling.

"Singapore and Malaysia will be the main beneficiaries of inflows into the region as global funds step up diversification into non-dollar assets after the US lost its top credit rating, according to Macquarie Group Ltd.

International investors will add to holdings of Singapore bonds, the only economy in Southeast Asia with a top rating from Standard & Poor’s, Moody’s Investors Service and Fitch Ratings, the bank said in a research note dated Aug. 6. Malaysia, which has the world’s largest Islamic debt market, will become more attractive to investors in the Middle East, according to Australia’s biggest investment bank."- Bloomberg

Read more: US downgrade to benefit Malaysia: Macquarie

Evaluating a company

In this post, I will share with you my approach in evaluating companies whose stocks are listed on the Malaysian stock exchange.

My method for evaluation is based on what I have read from a few books, mainly:

1. The Intelligent Investor - by Benjamin Graham

2. How to Make Money from Your Stock Investment Even in a Falling Market - by Ho Kok Mun

3. Secrets of Millionaire Investors - Adam Khoo and Conrad Alvin Lim

I invest in Malaysian stocks for the long term and for dividends. I do not use a trading approach.

My method for evaluation is based on what I have read from a few books, mainly:

1. The Intelligent Investor - by Benjamin Graham

2. How to Make Money from Your Stock Investment Even in a Falling Market - by Ho Kok Mun

3. Secrets of Millionaire Investors - Adam Khoo and Conrad Alvin Lim

I invest in Malaysian stocks for the long term and for dividends. I do not use a trading approach.

The Beginning - Investing in Malaysia

Let me start off by first telling you that I am an ordinary retail investor, a layman, who does not have a finance background and have never worked in the finance/banking/investment industry. However I am learning more about finance and investment, skills which I wish I have learned earlier in my life.

I started buying shares back in 2007, before the global financial crisis hit. I have invested in unit trust funds since more than 10 years ago, and did not bother to learn buying shares until then. Finally I decided to do it on my own by reading some investment books.

The purpose of this blog is just to share some information that you might find useful. These are information I use for evaluating stocks. It is not a recommendation to buy or sell. I also treat it as a learning process since I do not claim to be a great investor (if that was the case, I'll be charging money or holding courses ;)

I buy shares based on a fundamental approach. I will share with you in another post my current approach.

I started buying shares back in 2007, before the global financial crisis hit. I have invested in unit trust funds since more than 10 years ago, and did not bother to learn buying shares until then. Finally I decided to do it on my own by reading some investment books.

The purpose of this blog is just to share some information that you might find useful. These are information I use for evaluating stocks. It is not a recommendation to buy or sell. I also treat it as a learning process since I do not claim to be a great investor (if that was the case, I'll be charging money or holding courses ;)

I buy shares based on a fundamental approach. I will share with you in another post my current approach.

Subscribe to:

Posts (Atom)